Homeowners Insurance in and around Springfield

If walls could talk, Springfield, they would tell you to get State Farm's homeowners insurance.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Springfield

- Union

- Westfield

- Maplewood

- Chatham

- Short Hills

- Millburn

- Summit

- Union County

- Morris County

- Essex County

Insure Your Home With State Farm's Homeowners Insurance

New home. New memories. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help cover your home in case of windstorm or hailstorm, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they were injured on your property, the right homeowners insurance may be able to cover the cost.

If walls could talk, Springfield, they would tell you to get State Farm's homeowners insurance.

Help protect your home with the right insurance for you.

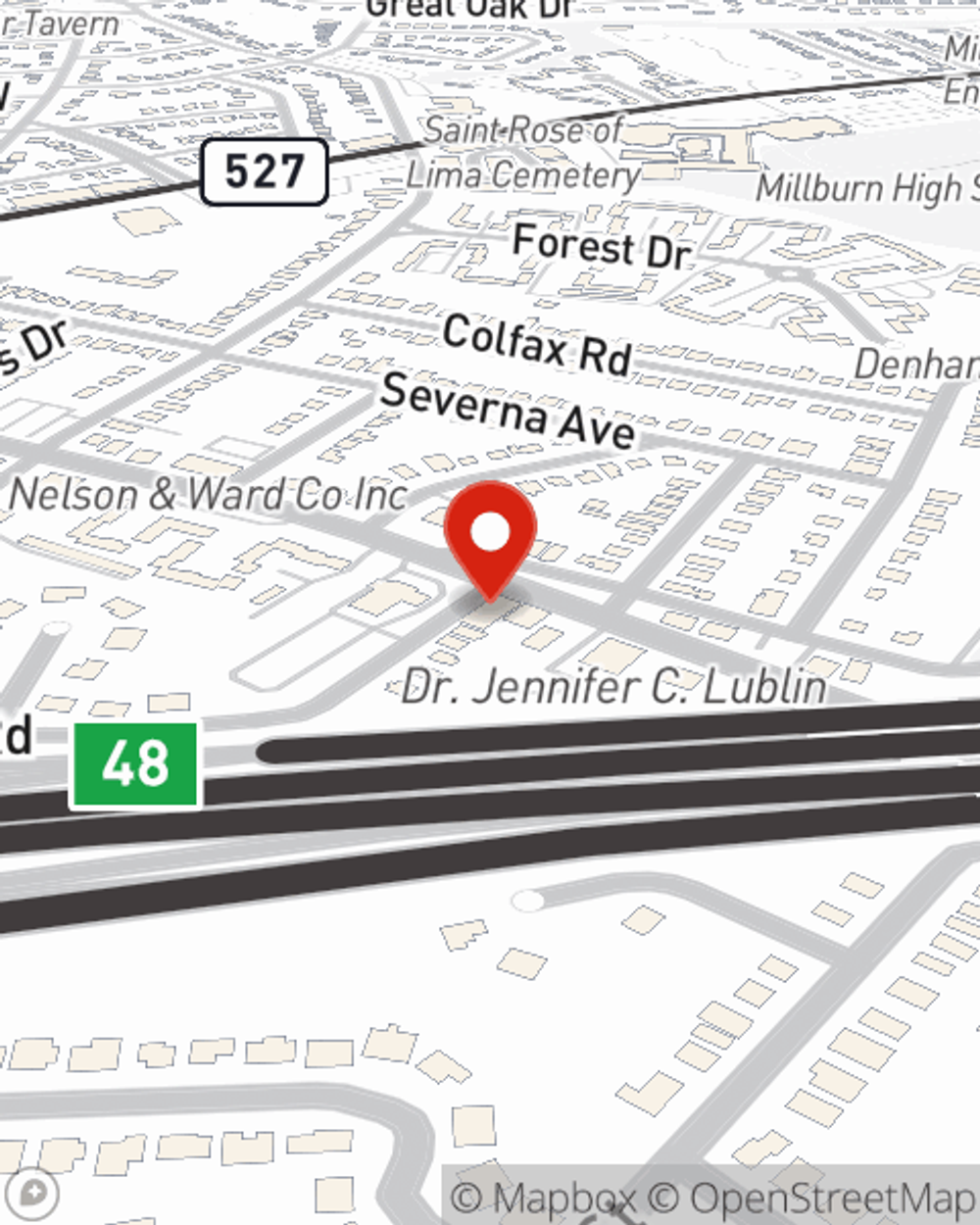

Agent Mike Scalera, At Your Service

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Mike Scalera can be there whenever mishaps occur, to get your homelife back to normal. State Farm is there for you.

So get in touch with agent Mike Scalera's team for more information on State Farm's outstanding options for protecting your home and momentos.

Have More Questions About Homeowners Insurance?

Call Mike at (973) 564-7717 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Why attic ventilation matters

Why attic ventilation matters

Proper attic ventilation is important, especially for homes located in climates where snow, ice dams and humidity problems are common.

Mike Scalera

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Why attic ventilation matters

Why attic ventilation matters

Proper attic ventilation is important, especially for homes located in climates where snow, ice dams and humidity problems are common.